If you’ve been following USBenefits Insurance Services articles you probably noticed a theme – the benefits and disadvantages of stop-loss (excess / self-insured) coverages and the importance of employing strategic plans. These plans could include, but are not limited to:

- implementing a risk management program,

- not getting caught in the low-price trap,

- exercising risk transfer strategies, and

- understanding the differences between mitigating vs managing claims.

If you are looking to buy a “one size fits all” standardized health insurance coverage, then fully insured/first dollar coverage should be your choice. However, if you want long-term stability, the ability to control the costs of your insurance product, and wish to evaluate your coverage to ensure a return-on-investment (ROI), then self insuring might be the financial vehicle you’re looking for. Yes, treat your insurance like an investment with ROI expectations.

According to Avalere’s June 28, 2022 analysis for the US Chamber of Commerce, employer-sponsored health insurance will provide an estimated 47% ROI to employers with 100 or more employees in 2022 and a 52% return in 2026. Key drivers of ROI include improved productivity, reduction in direct medical costs, and tax benefit.

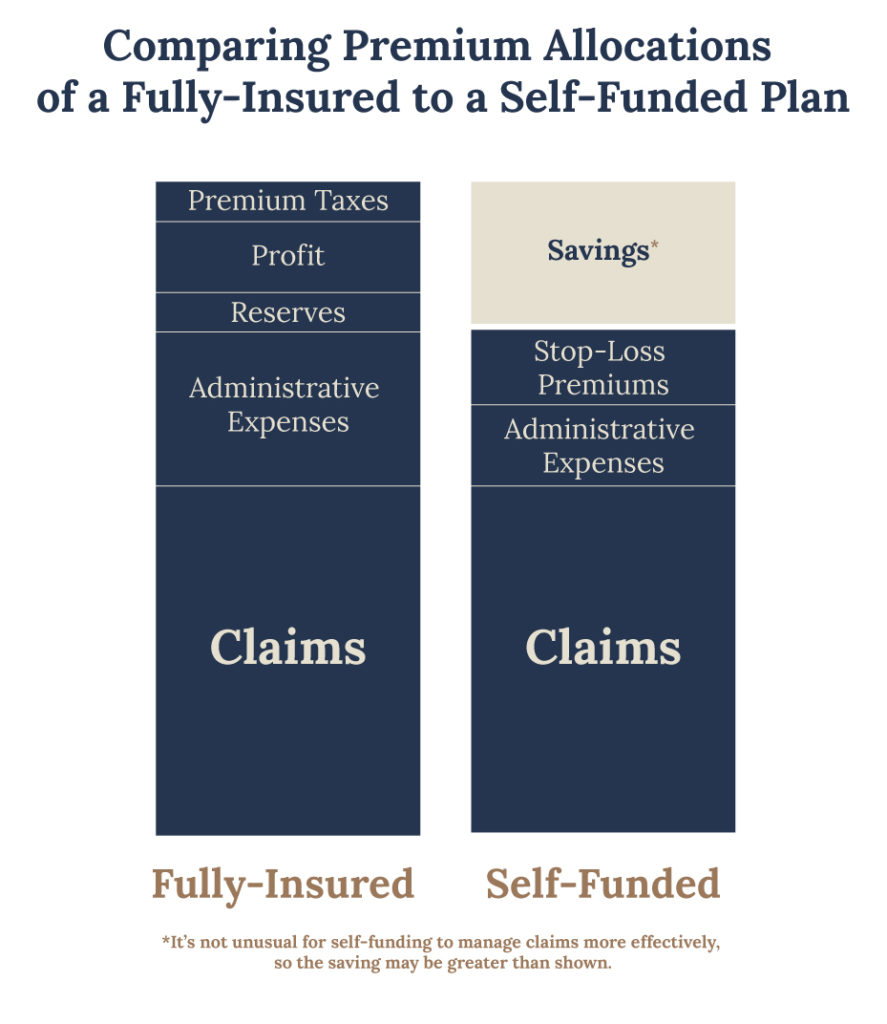

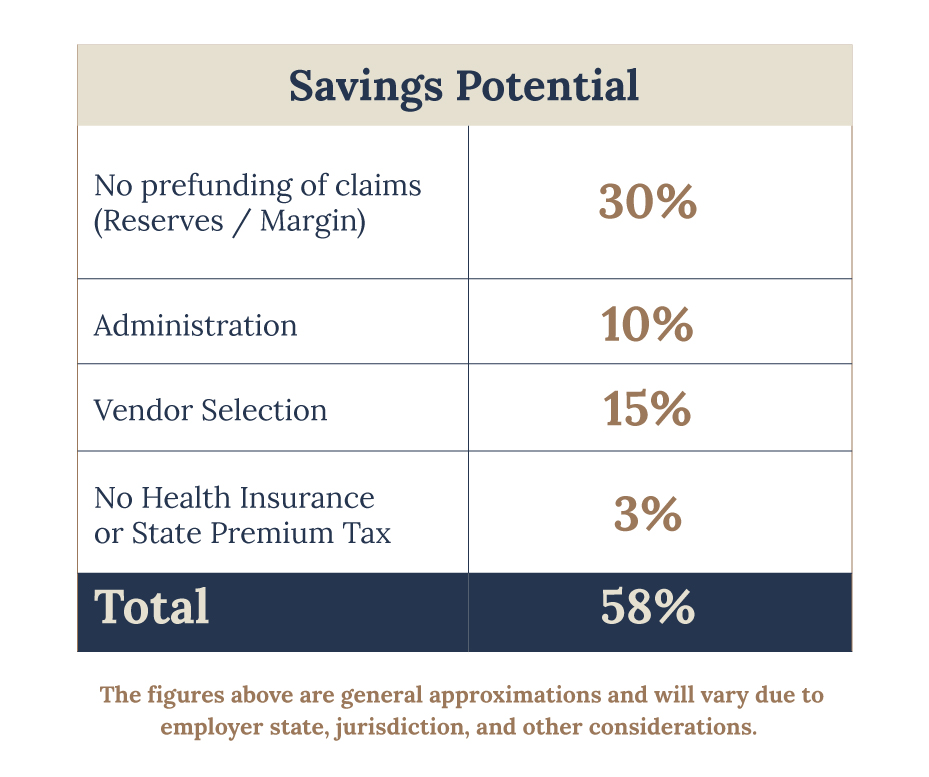

While the Avalere’s analysis speaks to savings from a human resources perspective, the exhibit below demonstrates the financial impact at the health plan level. It’s important to note that the “margin” is the employer’s cash flow benefit as this variable is not immediately paid, but is spread out during the policy period and is only subject to pay as needed.

Cutting to the chase, any employer contemplating excess coverage, should not be considering how much their immediate savings will be as compared to a fully insured / first dollar coverage. Excess coverage is a long-term play, and if done correctly, the employer will experience multiple benefits as noted by the Avalere’s report. While cost savings is the ultimate goal, it must be treated like an asset or investment of the company rather than transactional. That is, simply looking for the cheapest upfront cost does not necessarily translate to savings. For self insurance to be effective, the employer must be engaged and accountable, because like any investment, there’s risk.

Employers must treat this product strategically and align with partners, who share their immediate and long-term objectives.

The ideal self funded employer wants:

- Control

- Partner selection (Broker, TPA, Stop-Loss Carrier, etc.)

- Service selection (TPA, vendors, etc.)

- Employ Risk Management

- Plan and benefit design flexibility

- Data is available for analysis

- Cash Flow

- Some initial fixed costs, while others incurred during the policy period

- Claims are reserved until paid. Monies are generally set aside and invested.

- While these ERISA plans are not subject to insurance reserve requirements, if an employer anticipates claims liability (reserves and expenses) there may be financial / tax benefits.

- Not subject to state premium taxes

- Outcomes

- Better quality healthcare through a benefit plan that is tailored to the employee base and the ability to use cost savings to increase coverage

- Lower cost to employer and employees

- Long term stability and predictability

- Risk taking mentality

- Tax / financial benefits

Taking this one step further… It’s important for the employer to fully vet their partners and service providers to find those that best align with their benefits and financial objectives, as well as synergize as a your team. Not all partners or service providers are equal nor serves in your client’s best interest. USBenefits works in concert with our producers to produce the best outcome for the employer. Our motto is “Your goal is our goal – to provide the best possible outcome for the employer.” We invite you to read our Claims Success stories, where we helped all parties reduce their claim costs, or contact us today for more information.