When it comes to service, it may be hard to differentiate between Stop-Loss Providers on a “Request for Proposal” spreadsheet. As discussed in previous articles, choosing the lowest price may not be in the best interest of the Plan.

Let’s go a bit deeper into why claim service may be a better reason to select a stop-loss provider rather than price. Often, the parties involved with purchasing of stop loss are decided based on what they can see on a spreadsheet or presentation, this is usually in the underwriting portion. Often what is omitted and not discussed is how and what is the stop-loss carrier’s claim management’s performance.

At USBenefits, we review all claims closely to make sure the claims are paid based on the Plan document. While a lot of medical claim review vendors do a good job identifying billing errors, there are other billing issues that need to be reviewed. This includes reviewing medical procedures to ensure the procedures are appropriate based on current medical literature.

Almost all plan documents clearly state they do not pay for medical procedures that are not medically necessary. Therefore, it’s necessary that claims are reviewed closely to ensure that the treatment received by the claimant was appropriate and followed the proper medical guidelines. Running a claim through a software program is a common practice with cost containment vendors, however it will not always identify procedures that are not medically necessary, so it’s imperative to use a vendor that has the knowledge to identify these issues. At USBenefits, we use vendors that not only have the ability to identify billing errors, but also have doctors with the expertise in each specialty area, to identify unnecessary medical treatment.

Another area that is sometimes a concern, is that certain networks will not allow outside companies to audit the provider bill. Now, why would a network not allow an audit? While we don’t want to guess at the answer, the Plan has every right to not only audit a provider claim, but then pay the claim based on the Plan document. In fact, not only does the Plan have the right to audit, but as the fiduciary, they have a responsibility.

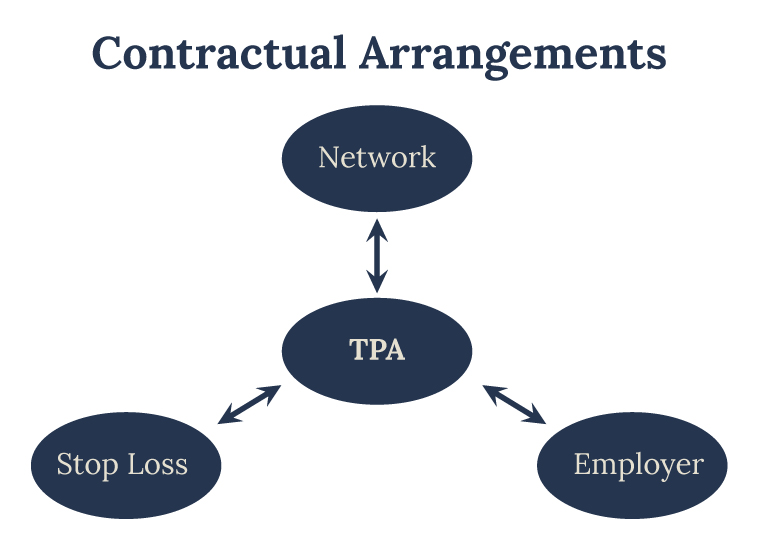

With medical costs consistently out pacing inflation, it requires a dedicated Stop-Loss provider working closely with the TPA/Plan, to help control costs. USBenefits is willing to take on providers that bill improperly to increase their profits. We do this by working with the best vendors in the business that were once providers themselves. Having a doctor call a facility to negotiate a bill gains instant credibility over someone that is just a negotiator.

At USBenefits, we work hard to save every nickel, dime, and quarter for the Plan. Don’t put your business with someone that is not fully invested in your best outcome. Further, to ensure your best outcome is our priority, USBenefits does not accept any financial or other forms of incentives from vendors that may cause a conflict of interest. After all, your goal is our goal – to provide the best possible outcome for the employer.